The United States has taxed the estates of decedents since 1916, and gifts since 1924, with tax rates and exemption levels that have varied greatly over the last two decades.

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. For example, the tax law doesn’t explicitly state that you can deduct office supplies and other expenses. Some expenses are detailed in the tax code, but the general rule is contained in the first sentence of Section 162, which states you can write off “all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.”

On Wednesday October 4, 2023, Massachusetts Governor Maura Healey signed a $1 billion tax package into law. This significant legislation will increase tax credits for caregivers, renters, and seniors, and provide benefits for the business community. Through this legislation, Healey hopes to make the cost of living more affordable to families.

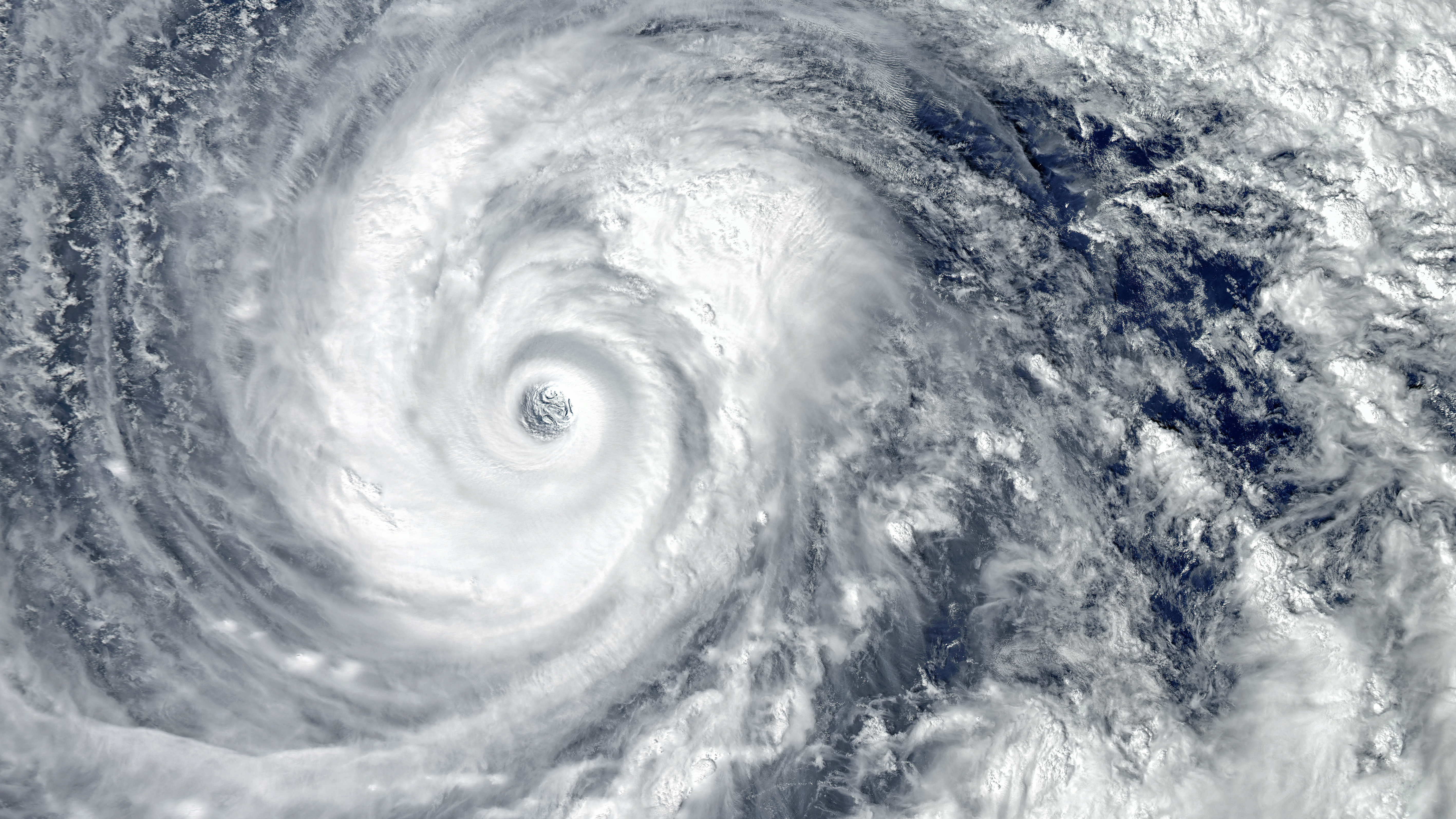

The IRS announced a deadline extension for certain taxpayers impacted by Hurricane Lee, which hit the east coast in September 2023. Taxpayers who reside in or have a business in affected areas will now have until February 15, 2024 to file individual and business tax returns and make tax payments that were originally due on or after September 15, 2023.

After issuing multiple warnings, the IRS has announced a moratorium on processing new Employee Retention Credit (ERC) refund claims through the end of the year. In combination with stepping up its audit and criminal investigation work regarding ERC claims, the IRS hopes the moratorium will slow down the ERC process to allow the organization to better identify which claims are legitimate.

If you play a major role in a closely held corporation, you may sometimes spend money on corporate expenses personally. These costs may end up being nondeductible both by an officer and the corporation unless the correct steps are taken. This issue is more likely to happen with a financially troubled corporation.

If you operate your small business as a sole proprietorship, you may have thought about forming a limited liability company (LLC) to protect your assets. Or maybe you’re launching a new business and want to know your options for setting it up. Here are the basics of operating as an LLC and why it might be a good choice for your business.