Divorce is stressful under any circumstances, but for business owners, the process can be even more complicated. Your business ownership interest is often one of your largest personal assets, and in many cases, part or all of it will be considered marital property. Understanding the tax rules that apply to asset division can help you avoid costly surprises.

After months of debate, the One Big Beautiful Bill Act (OBBBA) has become law, bringing sweeping changes to the U.S. tax code for both individuals and businesses. Below is a breakdown of a few of the most significant provisions, along with actionable planning insights. We will be providing a much deeper dive into this bill in the coming weeks.

The Senate is currently in a marathon “vote‑a‑rama” phase, reviewing hundreds of amendments to the “One Big Beautiful Bill” (OBBBA) passed by the House in May. That means significant changes remain possible before a final Senate vote—expected this week—followed by a return to the House and, ultimately, the President’s signature.

On May 22, 2025, the U.S. House of Representatives narrowly passed a comprehensive tax and spending bill, often referred to as the "One Big Beautiful Bill Act." This legislation encompasses significant tax reforms and spending measures. The bill now advances to the Senate, where it faces potential revisions and debates.

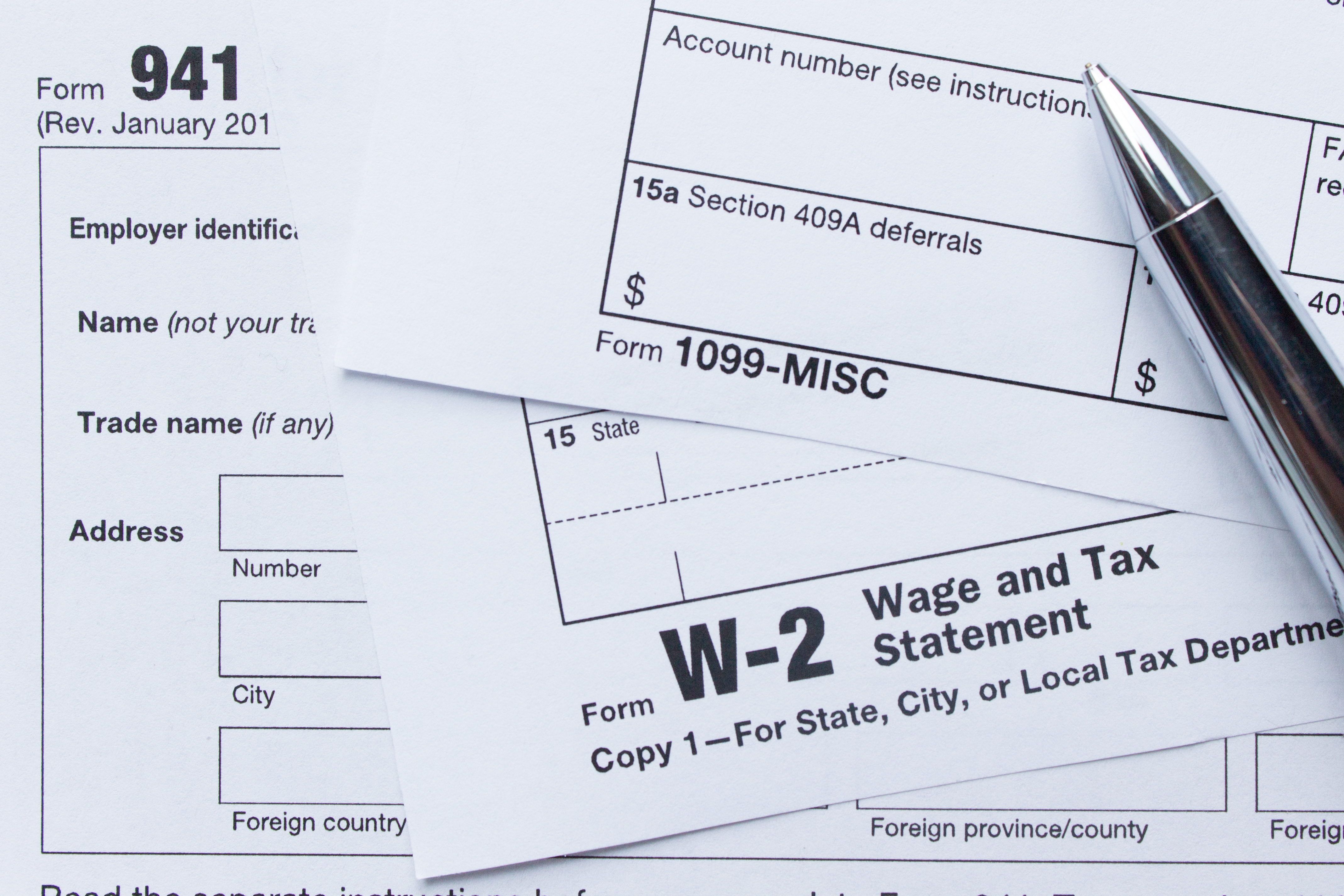

When it comes to employment and taxes, the distinction between a 1099 independent contractor and a W-2 employee is crucial. Each classification carries different tax responsibilities, benefits, and potential drawbacks. Understanding the implications can help you make informed financial decisions, whether you’re a worker choosing between roles or a business deciding how to classify your workforce.