As you may be aware, on June 28, 2018, Governor Charlie Baker signed a landmark bill requiring all employers in the state of Massachusetts to provide workers with paid family and medical leave—giving Massachusetts one of the most generous paid family and medical leave programs in the country.

Beginning in 2021, the program will provide the majority of Massachusetts "covered individuals", including employees and self-employed individuals who elect coverage, annual benefits of up to 20 weeks of paid medical leave for an individual to address their own serious medical issues, and up to 12 weeks of paid leave to bond with a new child or care for a family member.

The program will be administered by a newly appointed Department of Family and Medical Leave (DFML) within the Massachusetts Executive Office of Labor and Workforce Development. To provide funds for paid leave employers, employees—and in some circumstances even some 1099-MISC contractors, who have never before had taxes deducted—will contribute to a new Family and Medical Leave Trust Fund, via a mandatory 0.63% payroll tax, which is split between an employer contribution (0.312%) and covered individual contribution (0.318%).

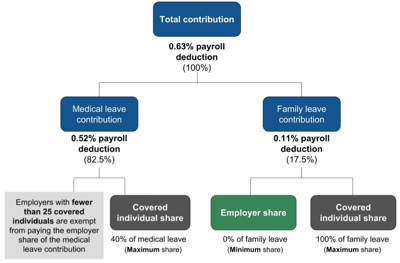

Employers with fewer than 25 "covered individuals" are exempt from paying the employer share of the medical leave contribution, but are still required to withhold and remit the individual contribution amounts.

Although the paid leave benefits for employees do not go into effect until January 1, 2021, there is a July 1, 2019 deadline that is quickly approaching for employers.

Prior to July 1, 2019:

- Notify each Massachusetts employee and 1099-MISC self-employed contractor in the following manner:

- Display the PFML workplace poster in a higly visble location

- Provide written to notice of contribution requirements, benefits and workforce protections to Massachusetts W-2 employees and Massachusetts 1099-MISC contractors

- Collect signed acknowledgements of receipt of such notice from Massachusetts W-2 employees and Massachusetts 1099-MISC contractors

Beginning July 1, 2019:

- Start withholding deductions from wages or payments for services made to your workforce to fund the quarterly contribution to the DFML

- Prepare for quarterly reporting of gross wages or other payments to all Massachusetts W-2 employees and Massachusetts 1099-MISC contract workers, as determined necessary

- Report individual wages, hours work on quarterly basis beginning October 31, 2019 for the July 1, 2019 - September 30, 2019 quarter

- Remit all contributions following each quarterly report that is filed with DFML

- Quarterly reporting to the DFML is done via MassTaxConnect. You can log into your MassTaxConnect account or register your business with MassTaxConnect here: https://mtc.dor.state.ma.us/mtc/

- The first quarter employee and employer contributions are due by October 31, 2019 for the July 1, 2019 - September 30, 2019 quarter

General contribution factors and determining who is a covered individual:

The average size of your Massachusetts workforce for the prior calendar year will determine your covered individuals and contribution amount. Your Massachusetts workforce includes all Massachusetts W-2 employees, defined as anyone whom you issue a W-2 form for performing services in Massachusetts, and Massachusetts 1099-MISC contractors, defined as an individual who resides in Massachusetts for whom you are required to report payment of services of IRS Form 1099-MISC.

Depending on the actual breakdown of your Massachusetts workforce for the prior calendar year, your covered individuals and contribution will be determined in one of the following manners:

- Whether you will be required to remit contributions only for Massachusetts W-2 employees or for self-employed Massachusetts 1099-MISC contractors providing services to you as well

- Whether you will be responsible for paying into the employer share of the PFML contribution

Determining who is a covered individual:

- W-2 employees will always count as covered individuals

- 1099-MISC contractors count toward your total number of overed individuals only if they make up more than 50% of your total workforce (W-2 employees and 1099-MISC contractors combined)

Determining required contributions:

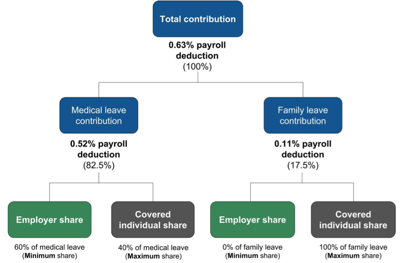

The contribution rate for employers with 25 or more employees consists of a total contribution of 0.63% of gross wages up to the Social Security wage limits, will be shared by the employer and employee, and is broken down as follows:

- Medical Leave Contribution will be 0.52% with up to 40% of the contribution (0.208%) able to be deducted from employee wages, with the remainder (0.312%) being the employer's responsibility

- Family Leave Contribution will be 0.11% of gross wages, with up to 100% of the contribution able to be deducted from employee wages

The contribution rate for employers with less than 25 employees consists of a total contribution of just the employees share, or a total of 0.318% broken down as follows:

- Medical Leave Contribution will be 0.208% with up to 100% of the contribution able to be deducted from employee wages, with no employer share amount.

- Family Leave Contribution will be 0.11% of gross wages, with up to 100% of the contribution able to be deducted from employee wages

Exemption for approved private plans:

If you already provide a paid leave benefit to your workforce, you may be able to receive an exemption from collecting, remitting and paying contributions under the Massachusetts PFML law.

There can be varying levels of penalties for failing to comply with PFML reporting and contributions. If you have any questions as you prepare to adopt these changes, please don't hesitate to reach out, we are happy to help! You can also access additional information regarding your responsibilities related to the the Massachusetts PFML law on the following Mass.gov website pages:

https://www.mass.gov/paid-family-and-medical-leave-for-massachusetts-employers

https://www.mass.gov/info-details/paid-family-medical-leave-for-employers-faq#latest-questions-submitted-to-dfml-.