Intangible assets, such as patents, trademarks, copyrights and goodwill, play a crucial role in today’s businesses. The tax treatment of these assets can be complex, but businesses need to understand the issues involved. Here are some answers to frequently asked questions.

Recent Posts

In recent years, the debate surrounding wealth inequality and tax reform has gained significant traction across the US. Among the states at the forefront of this conversation is Massachusetts, where the “Millionaires Tax” has sparked both support and opposition. In November of 2022, Massachusetts approved the Fair Share Amendment, a 4% tax on state residents with an annual income of greater than $1 million.

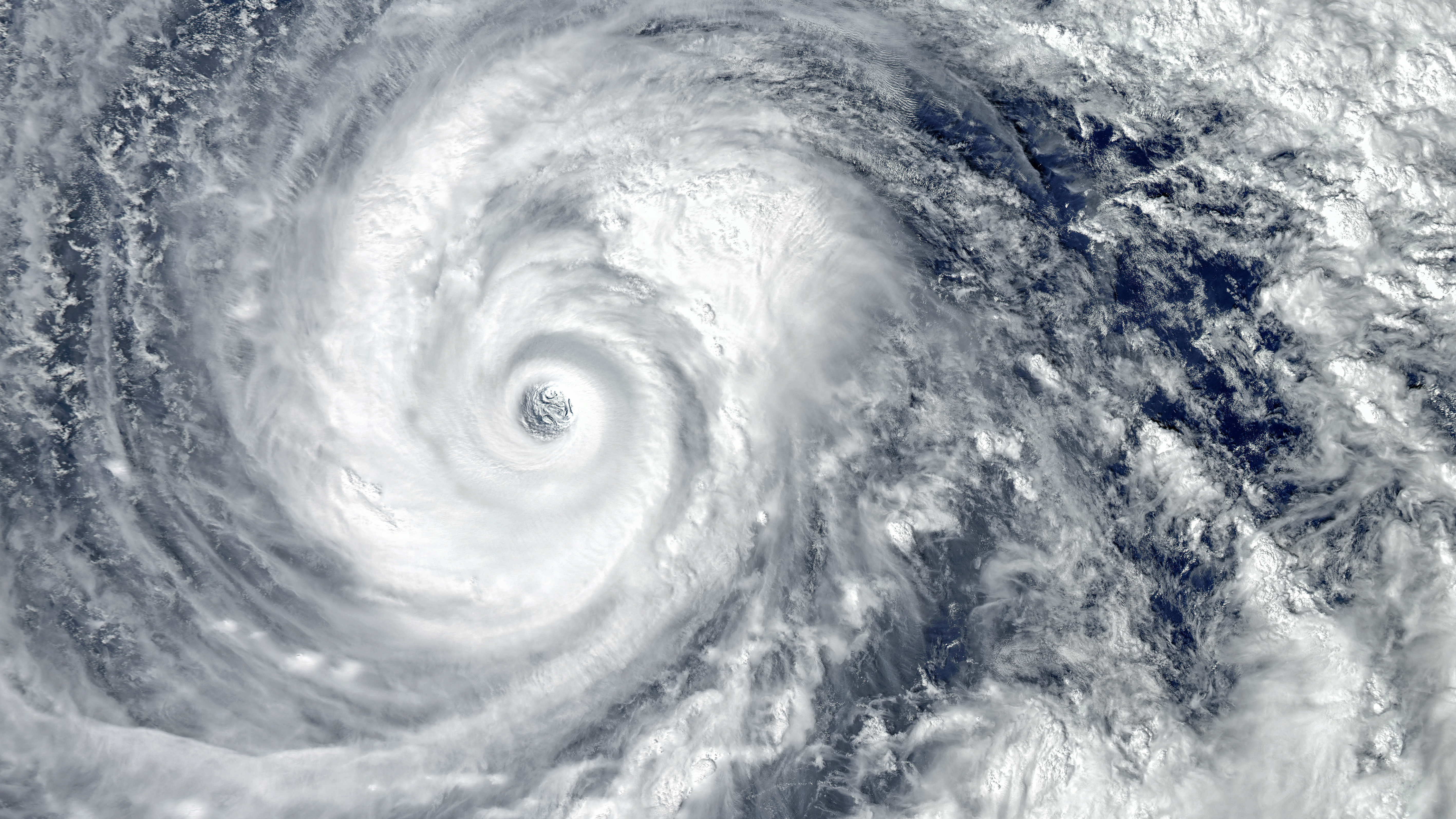

The IRS announced a deadline extension for certain taxpayers impacted by Hurricane Lee, which hit the east coast in September 2023. Taxpayers who reside in or have a business in affected areas will now have until February 15, 2024 to file individual and business tax returns and make tax payments that were originally due on or after September 15, 2023.

It’s been years since the Tax Cuts and Jobs Act (TCJA) of 2017 was signed into law, but it’s still having an impact. Several provisions in the law have expired or will expire in the next few years. One provision that took effect last year was the end of current deductibility for research and experimental (R&E) expenses.

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year and next. The standard year-end approach of deferring income and accelerating deductions to minimize taxes will likely produce the best results for most businesses, as will bunching deductible expenses into this year or next to maximize their tax value.